Introduction

Payment orchestration is emerging as a game-changer in the world of financial transactions, particularly for industries like airlines, travel, and e-commerce. This article will explore how this innovative approach redefines the payment landscape, offering unparalleled efficiency and cost-effectiveness. We'll explore the rise of payment orchestration, juxtaposing it with traditional payment acceptance methods, to understand why it's becoming indispensable for CFOs, finance directors, and payment managers.

The Rise of Payment Orchestration

The payment process was relatively straightforward in the past, dominated by a few key players. However, the rapid evolution of technology and consumer expectations has led to a more complex and dynamic payment ecosystem. Payment orchestration represents a significant leap forward in this evolution.

Traditional payment systems often involve a single payment service provider (PSP), which can limit flexibility and increase dependency. In contrast, payment orchestration introduces a multi-faceted approach, integrating multiple PSPs, card acquirers and payment methods. This transition is not just a trend but a response to the growing demands of a global customer base, especially evident in sectors like airlines, travel, and e-commerce.

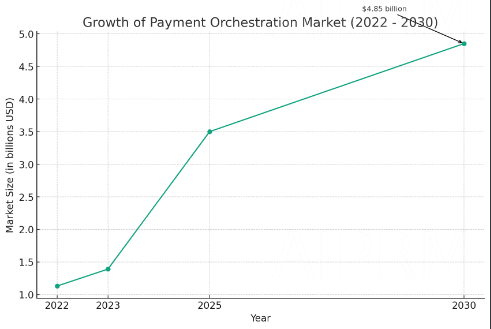

Statistics show a notable shift towards payment orchestration:

The global payment orchestration platform market size was valued at USD 1.13 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.7% from 2023 to 2030.

- Grand View Research / SkyQuestt

Understanding Payment Orchestration

At its core, payment orchestration is about streamlining and optimizing the payment process. It involves managing a variety of payment gateways, methods, and currencies through a single platform. This orchestration ensures that transactions are routed through the most efficient paths, considering factors like transaction costs, success rates, and customer preferences.

This system offers a crucial advantage for industries that handle a high volume of transactions, like airlines and e-commerce. Payment orchestration can intelligently route transactions to the PSP that provides the best terms for that specific transaction, be it lower fees, higher acceptance rates, or faster processing. This flexibility is key in a landscape where customer satisfaction and cost-efficiency are paramount.

Benefits for Airlines, Travel, and E-commerce

One of the primary benefits of payment orchestration is cost reduction. By intelligently routing transactions to the most cost-effective PSPs, businesses can significantly reduce their payment processing fees. This is particularly beneficial for airlines and travel companies, where margins can be tight, and payment fees can add up quickly.

Another critical advantage is the maximization of acceptance rates. Payment orchestration ensures that each transaction is processed through the PSP with the highest likelihood of success. This is vital in e-commerce, where a declined transaction can mean a lost sale. Increased acceptance rates directly translate to higher revenues and customer satisfaction.

Challenges and Considerations

While payment orchestration offers significant benefits, it has its challenges. One primary concern is the complexity of integrating multiple PSPs into a single system. This requires careful planning and a robust technical infrastructure. Additionally, maintaining compliance with various regional and international payment regulations can be daunting, especially for global businesses like airlines and e-commerce platforms.

To successfully implement a payment orchestration system, businesses must consider these factors carefully. Partnering with experienced payment orchestration providers, like APEXX can help navigate these challenges, ensuring a smooth and compliant integration.

Future Outlook

The future of payment orchestration looks promising, particularly as global e-commerce grows. The ability to adapt quickly to new payment methods and currencies and to meet the evolving demands of a diverse customer base will be crucial for businesses. Payment orchestration is poised to become a standard practice, offering the agility and efficiency required in a rapidly changing financial landscape.

Emerging technologies like AI and machine learning are expected to enhance payment orchestration systems further, making them more intelligent and efficient. This could mean even more significant cost savings and improved customer experiences, solidifying the role of payment orchestration in the finance and payment sector.

Conclusion

Payment orchestration represents a significant evolution in the way businesses handle financial transactions. Its ability to minimize costs and maximize acceptance rates makes it an invaluable tool, especially for airlines, travel, and e-commerce sectors. As the world moves towards a more integrated and efficient payment system, those who embrace payment orchestration will find themselves at the forefront of this change.

For businesses looking to explore the benefits of payment orchestration, APEXX Global offers expert guidance and solutions.